All Categories

Featured

Table of Contents

- – Which Course Is The Top Choice For Investors I...

- – How Does Bob Diamond Define Success In Foreclo...

- – What Are The Most Effective Learning Strategi...

- – How Do I Select The Right Training For Real E...

- – What Are Bob Diamond's Tips For Effective Pr...

- – What Should I Expect From An Wealth Building...

Doing so doesn't cost thousands of hundreds of dollars like acquiring multiple tax obligation liens would. Instead, your study, which may involve avoid tracing, would certainly cost a fairly little cost. Any state with an overbid or premium bid method for public auctions will certainly have tax sale overage possibilities for financiers. Keep in mind, some state laws protect against overage alternatives for past owners, and this problem is in fact the subject of a current High court instance.

Your sources and method will figure out the finest environment for tax overage investing. That stated, one strategy to take is accumulating rate of interest on high premiums.

Which Course Is The Top Choice For Investors In Claim Management?

Any type of public auction or foreclosure involving excess funds is an investment chance. You can invest hours investigating the previous owner of a residential property with excess funds and contact them only to uncover that they aren't interested in going after the cash.

You can start a tax obligation overage business with very little expenditures by finding details on recent residential or commercial properties cost a premium proposal. After that, you can get in touch with the previous owner of the home and offer a price for your services to assist them recover the excess. In this circumstance, the only cost entailed is the research instead of spending 10s or numerous thousands of bucks on tax liens and acts.

These excess usually create rate of interest and are offered for past proprietors to insurance claim. Consequently, whether you purchase tax liens or are exclusively thinking about insurance claims, tax obligation sale excess are investment chances that need hustle and strong research to profit.

How Does Bob Diamond Define Success In Foreclosure Overages?

Pro Members Obtain Complete Access Succeed in property investing with proven toolkits that have aided countless aspiring and existing financiers accomplish economic flexibility. $0 TODAY $32.50/ month, billed every year after your 7-day trial. Cancel anytime.

These homes are marketed "AS IS", at the risk of the buyers and neither the County neither any kind of other party makes service warranties or depictions whatsoever either shared or implied, of any kind, relative to the buildings or the title thereto. In the occasion a tax sale certificate is released and then invalidated by the Supervisor of Money via no mistake of the buyer just a reimbursement of quantities actually paid on the day of sale will be made and shall be the Supervisor of Finance's sole liability and restriction thereon.

The sale, the facilities, and the buildings are, to the extent provided by law, based on any and all title flaws, insurance claims, liens, encumbrances, commitments, problems, restrictions, easements, right-of-way and matters of records. In case of an error, faulty title, summary or non-existence of residential or commercial property, no reimbursement shall be offered.

What Are The Most Effective Learning Strategies For Real Estate Training?

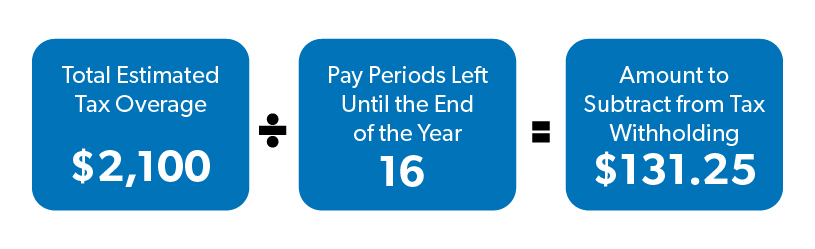

Tax obligation sale overages occur when a tax-foreclosed residential or commercial property is marketed at public auction for a greater cost than the owed taxes., additionally called excess, are the difference between the sale price and the tax obligations due.

Excess profits recovery is a legal process that allows homeowner to recoup any kind of excess funds (additionally recognized as Overages) left over after a residential or commercial property has actually been cost a tax obligation sale. In Texas, the procedure of excess proceeds recuperation can be complex, and it's important to have a skilled attorney in your corner to guarantee that you obtain the total of funds owed to you.

In this post, we'll supply an overview of excess earnings recuperation and the steps you require to require to assert your funds (opportunity finder). Excess earnings are the funds left over after a residential property has actually been sold at a tax obligation sale for even more than the quantity of delinquent tax obligations, charges, interest, and costs owed on the building

How Do I Select The Right Training For Real Estate Workshop?

These include:: You must file a case for the excess profits with the county area court in the county where the residential or commercial property was sold. The case has to be submitted within the defined time period, commonly 2 years from the day of the sale. Property tape-recorded for a corporation need to be stood for in court by an attorney in Texas.

Each district court usually has particular documentation and sustaining evidence required for healing of excess proceeds.: You might be needed to pay court or filing charges to submit your claim, along with any type of additional management & processing charges required to acquire your excess proceeds.: If there are numerous insurance claims on the excess profits, a hearing may be required to identify the rightful owner.

At the we can help you with every action of the excess proceeds healing process. tax lien. Our skilled attorneys can help you file a case, offer the essential paperwork and study, safeguard you and your insurance claim against completing claimants and represent you at any called for hearings. If you are a homeowner or lienholder in Texas, you may be entitled to excess profits from a tax obligation sale

What Are Bob Diamond's Tips For Effective Property Overages?

Any kind of monies staying after the satisfaction of the tax obligation sale are thought about to be Excess Earnings. Celebrations of Interest may claim the Excess Earnings within a specified period of time (Income and Taxes Code (RTC) 4671 et seq.).

Insurance claims are filed with the Auditor-Controller, Real Estate Tax Division. Early receipt is recommended as there is no poise duration. The Complaintant births the responsibility to make sure distribution. It is recommended that some kind of postal solution monitoring be utilized when sending by mail an Insurance claim, particularly if close to the due date.

What Should I Expect From An Wealth Building Training Program?

Layout Insurance claims are available in the kinds section on this page (select one layout Insurance claim per Claimant). Each template Insurance claim contains directions. For concern or support, please contact the Auditor-Controller by phone ( 530) 621-5470, ext. 4 or e-mail AuditorPropertyTaxDivision@edcgov.us!.?.!. Keep in mind that State law does not need a specific layout to an Insurance claim. If the Plaintiff picks to use a freeform Claim layout, please make certain that all necessary information is supplied. Complying with the expiry of the declaring duration, the Auditor-Controller will present legitimate Claims in a Board of Manager's (BOS)public hearing. Claims will not be heard by the BOS till after the asserting period has actually run out.

Table of Contents

- – Which Course Is The Top Choice For Investors I...

- – How Does Bob Diamond Define Success In Foreclo...

- – What Are The Most Effective Learning Strategi...

- – How Do I Select The Right Training For Real E...

- – What Are Bob Diamond's Tips For Effective Pr...

- – What Should I Expect From An Wealth Building...

Latest Posts

List Of Tax Lien Properties

Tax Lien Foreclosures For Sale

Tax Ease Lien Investments

More

Latest Posts

List Of Tax Lien Properties

Tax Lien Foreclosures For Sale

Tax Ease Lien Investments